NEARLY 4 IN 10 FREIGHT FORWARDERS LOSE MARGIN DURING LUNAR NEW YEAR PERIOD, SURVEY FINDS

Jan 29, 2026

Internal execution gaps, not market forces, emerge as the primary driver of poor performance in the build—up to China's annual factory shutdown.

January 2026

A global survey of 700 freight forwarding professionals by OntegosCloud reveals that most forwarders lose margin or merely hold ground during the Lunar New Year period - with delayed decision-making, poor visibility, and misalignment between teams cited more frequently than capacity constraints or carrier behaviour.

According to the survey, most forwarders approach Chinese New Year (CNY) defensively, focusing on damage limitation rather than growth. Only a small minority say they consistently use the period to gain competitive advantage.

“Chinese New Year has quietly become a profit separator,” said Oliver Gritz, founder and CEO of OntegosCloud. “The market conditions are largely the same for everyone, and it really should be approached as an opportunity. But too many companies survive rather than thrive. What differs is how prepared organisations are to execute under pressure.”

CNY falls on 17 February 2026, but factory closures typically span two to three weeks. The resulting pre-holiday export rush is already pushing container spot rates higher as demand rises, with air freight markets set to spike as the shutdown approaches.

The Chinese New Year period remains value-destructive for the industry

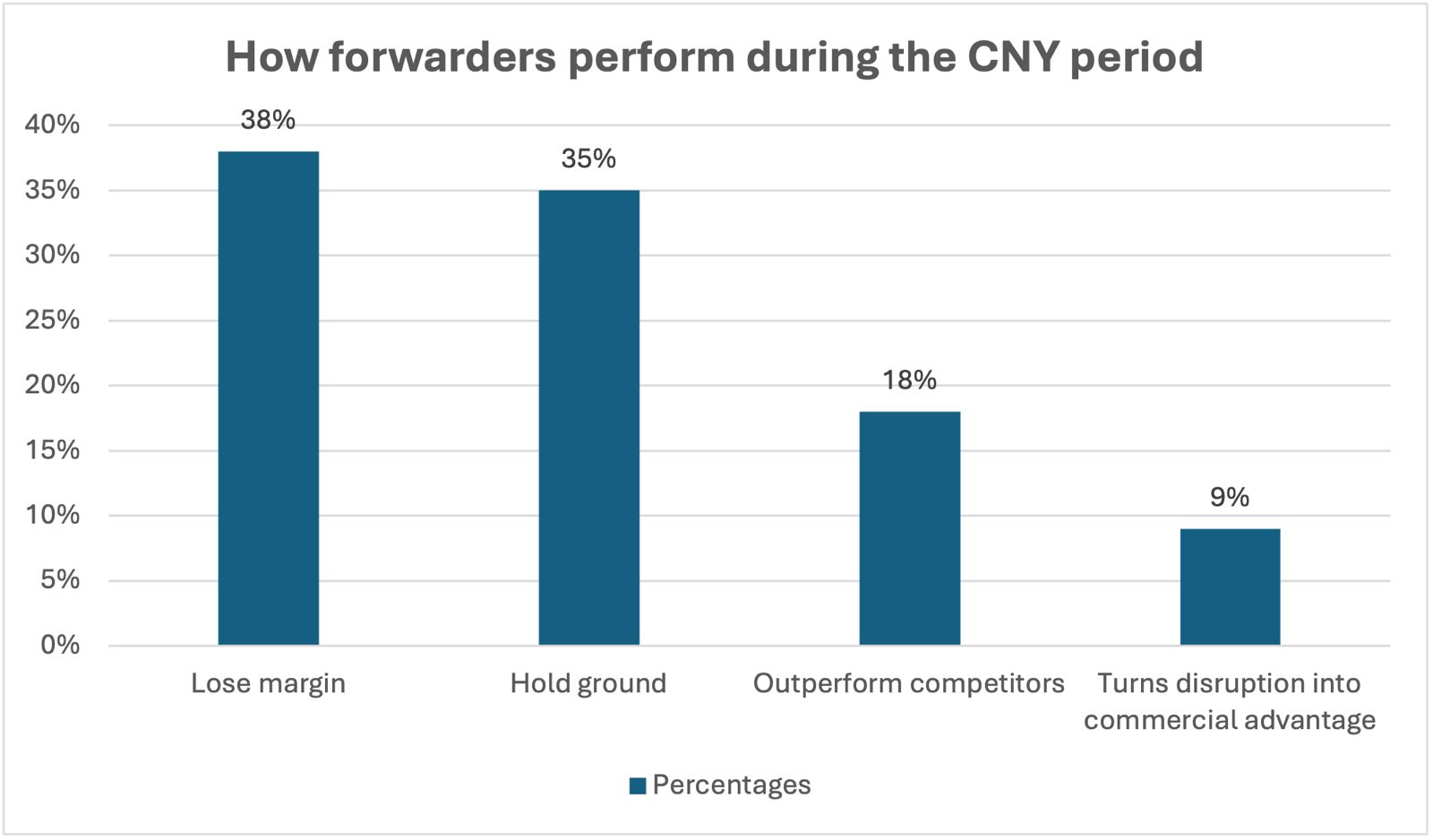

When asked about commercial outcomes during the CNY period, the survey reveals it is value-destructive for most of the industry. Nearly four in ten respondents say their organisations typically lose margin while trying to keep customers satisfied, while a further 35% report merely ‘holding ground’ without gaining any commercial upside.

By contrast, only 18% say they outperform less-prepared competitors during the CNY period, and just 9% report turning the disruption into a sustained commercial advantage, underscoring how sharply the period separates a small group of winners from the rest of the market.

Chart 1: Chinese New Year separates commercial winners from the rest of the market

Internal execution factors determine CNY outcomes

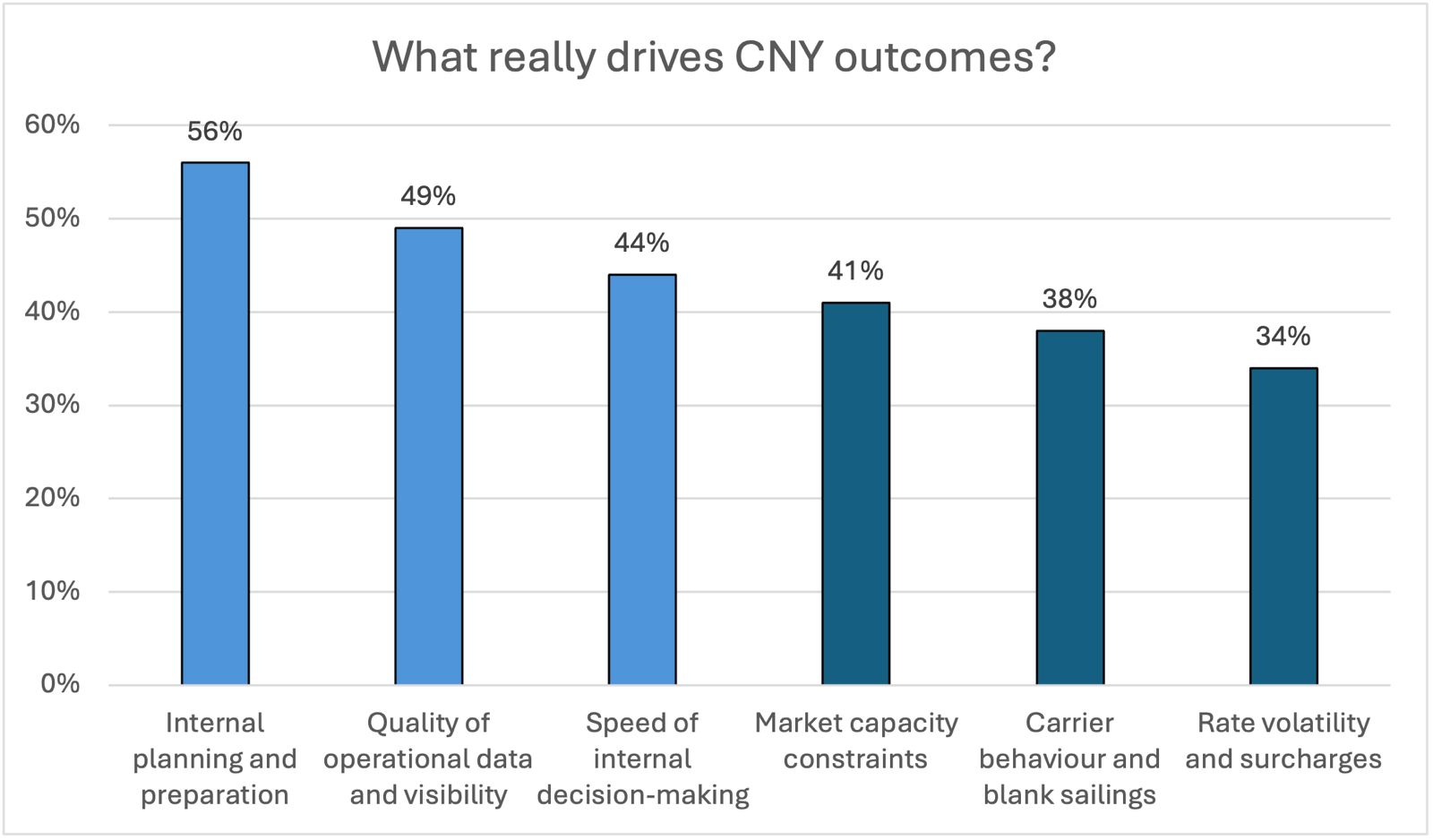

Contrary to common perception, respondents more frequently cited internal execution factors than external market forces as the primary drivers of Chinese New Year outcomes.

Chart 2: Internal execution matters more than market forces during Chinese New Year

While capacity constraints and carrier behaviour remain significant structural pressures during the CNY lead-in, the survey suggests these forces are broadly experienced across the market and affect most forwarders in similar ways. What differentiates outcomes is how organisations prepare for and execute within those conditions.

By contrast, internal planning and preparation (56%), quality of operational data and visibility (49%), and speed of internal decision-making (44%) emerged as the clearest differentiators in determining how organisations perform through the CNY period.

Most common internal breakdowns

In a follow-up question asking respondents to assess the extent to which internal execution issues amplify Chinese New Year-related challenges, with options ranging from “significantly” and “moderately” to “slightly” or “not at all”, more than 83% indicated that execution gaps play a significant or moderate role. The finding reinforces the view that CNY outcomes are shaped less by the disruption itself than by how organisations respond to it once pressure builds.

The most common internal breakdowns during the build-up to CNY were:

-

Delayed or reactive decision-making (52%)

-

Limited real-time visibility into shipments and margins (47%)

-

Poor alignment between operations, pricing, and finance (43%)